Contact Us Now for Trusted Debt Consultancy Services in Singapore

Contact Us Now for Trusted Debt Consultancy Services in Singapore

Blog Article

Open the Perks of Engaging Financial Obligation Expert Solutions to Navigate Your Path Towards Financial Obligation Relief and Financial Freedom

Involving the solutions of a financial obligation expert can be a critical action in your journey towards achieving financial debt relief and economic stability. These professionals offer customized methods that not only assess your one-of-a-kind economic scenarios however also give the crucial support required to browse complicated negotiations with financial institutions. Comprehending the multifaceted advantages of such expertise might reveal alternatives you hadn't formerly thought about. Yet, the question stays: what specific benefits can a financial debt specialist offer your monetary situation, and exactly how can you identify the ideal companion in this venture?

Comprehending Debt Specialist Solutions

Exactly how can financial obligation expert solutions transform your financial landscape? Financial obligation consultant services use specialized advice for individuals coming to grips with monetary obstacles. These specialists are trained to evaluate your monetary circumstance adequately, giving tailored strategies that line up with your special conditions. By assessing your income, debts, and expenses, a financial obligation specialist can assist you recognize the root triggers of your financial distress, permitting a more accurate method to resolution.

Financial obligation experts normally utilize a multi-faceted method, which might include budgeting assistance, settlement with financial institutions, and the advancement of a calculated payment plan. They serve as middlemans in between you and your lenders, leveraging their experience to work out much more beneficial terms, such as reduced passion prices or extended repayment timelines.

In addition, financial obligation professionals are furnished with up-to-date understanding of relevant legislations and regulations, guaranteeing that you are informed of your rights and options. This professional guidance not only relieves the emotional problem associated with financial debt however also equips you with the devices required to gain back control of your financial future. Eventually, engaging with debt consultant services can cause a much more structured and enlightened path toward economic security.

Secret Benefits of Expert Assistance

Involving with financial debt specialist services provides various benefits that can substantially boost your monetary scenario. One of the primary advantages is the competence that consultants bring to the table. Their comprehensive understanding of debt administration methods permits them to tailor services that fit your unique scenarios, ensuring a more effective technique to accomplishing financial security.

In addition, debt professionals usually provide settlement support with creditors. Their experience can result in more beneficial terms, such as lowered passion prices or cleared up financial debts, which might not be attainable through straight arrangement. This can result in significant monetary alleviation.

Additionally, specialists provide an organized prepare for repayment, helping you focus on financial obligations and assign sources effectively. This not only simplifies the settlement process but additionally promotes a feeling of accountability and development.

Eventually, the combination of expert advice, arrangement abilities, structured payment strategies, and psychological assistance positions financial obligation experts as valuable allies in the pursuit of financial obligation alleviation and financial freedom.

How to Choose the Right Expert

When selecting the ideal financial debt specialist, what essential aspects should you take into consideration to make sure a favorable end result? Initially, assess the professional's credentials and experience. debt consultant services singapore. Search for accreditations from acknowledged organizations, as these indicate a level of professionalism and knowledge in financial obligation monitoring

Next, consider the specialist's online reputation. Research study on-line evaluations, endorsements, and ratings to evaluate previous customers' complete satisfaction. A solid track record of successful debt resolution is crucial.

Additionally, assess the expert's method to financial obligation management. An excellent consultant ought to supply individualized services customized to your special financial scenario rather than a one-size-fits-all solution - debt consultant services singapore. Transparency in their charges and processes is essential; guarantee you understand the costs involved before committing

Communication is another vital variable. Choose a professional that is approachable and eager to answer your concerns, as a strong working connection can boost your experience.

Common Financial Obligation Alleviation Strategies

While various financial debt alleviation approaches exist, choosing the right one depends on private monetary circumstances and goals. Several of one of the most usual strategies consist of debt consolidation, financial debt monitoring strategies, and financial debt negotiation.

Financial obligation debt consolidation involves integrating several debts right into a solitary car loan with a lower rate of interest. This strategy simplifies payments go now and can minimize monthly commitments, making it simpler for people to regain control of their financial resources.

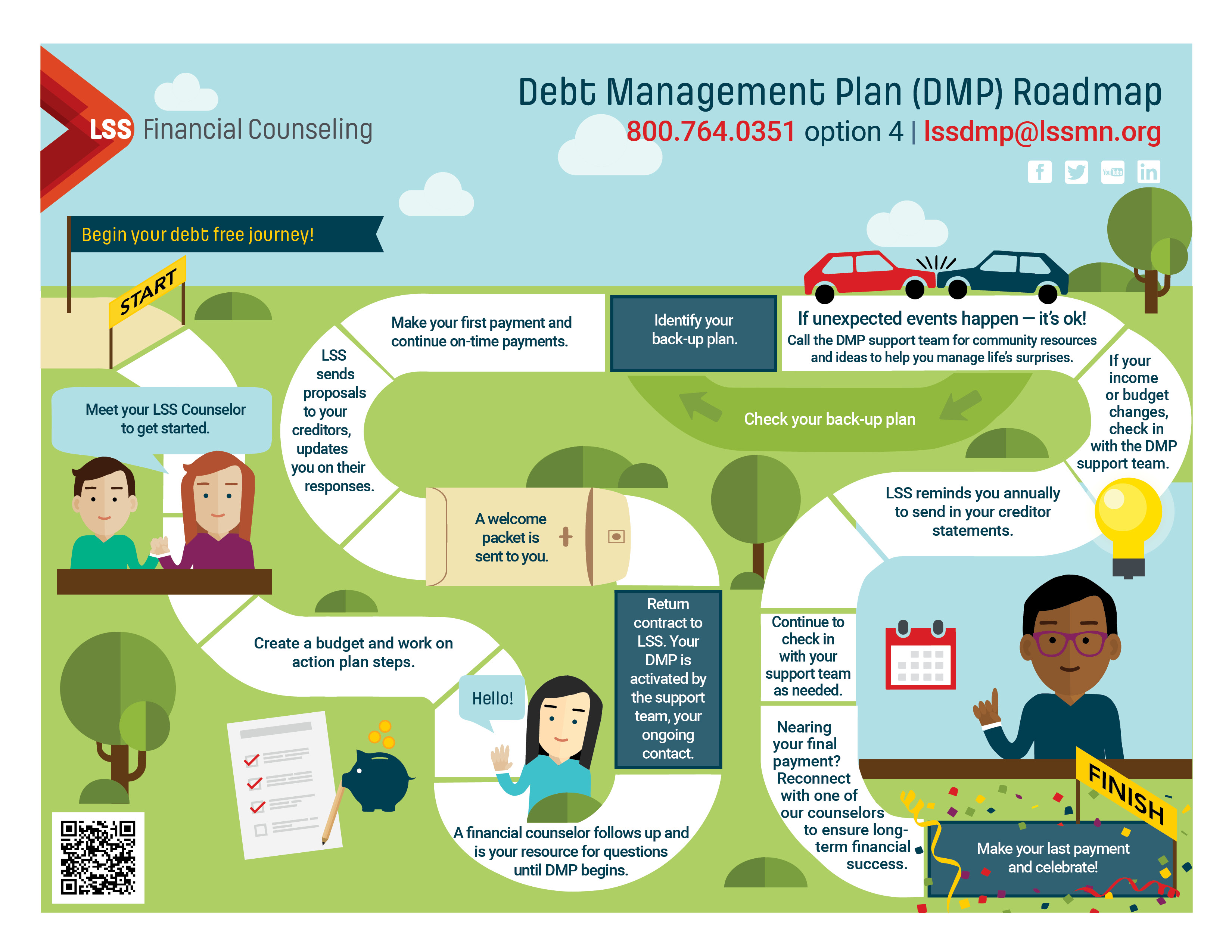

Financial debt monitoring plans (DMPs) are designed by credit report therapy agencies. They bargain with financial institutions to lower rates of interest and create a structured layaway plan. This alternative allows people to pay off debts over a set duration while profiting from specialist assistance.

Debt negotiation requires discussing directly with financial institutions to settle financial debts for less than the overall quantity owed. While this approach can give instant relief, it might affect credit report and commonly entails a lump-sum repayment.

Lastly, insolvency is a lawful choice that can give remedy for frustrating financial obligations. Nonetheless, it has lasting monetary ramifications and should be considered as a last hope.

Choosing the proper strategy calls for careful assessment of one's economic situation, making certain a tailored strategy to attaining long-term stability.

Steps Towards Financial Flexibility

Following, establish a sensible spending plan that prioritizes basics and cultivates cost savings. This spending plan must consist of provisions for financial obligation payment, permitting you to allocate excess funds efficiently. Following a budget plan aids cultivate regimented investing behaviors.

Once a budget remains in location, think about involving a financial obligation professional. These specialists offer customized approaches for handling and reducing debt, giving understandings that can quicken your journey toward monetary liberty. They might advise options such as financial obligation loan consolidation or settlement with financial institutions.

In addition, emphasis on building a reserve, which can protect against future economic pressure and offer satisfaction. Finally, spend in economic proficiency with resources or workshops, enabling informed decision-making. With each other, these actions develop an organized strategy to attaining economic flexibility, changing goals right into truth. With dedication and informed activities, the possibility of a debt-free future is available. look at this website

Final Thought

Engaging financial debt consultant solutions uses a critical strategy to achieving debt alleviation and monetary liberty. Inevitably, the knowledge of financial debt professionals considerably boosts the possibility of navigating the complexities of debt monitoring properly, leading to an extra safe monetary future.

Involving the solutions of a debt professional can be a critical action in your trip towards accomplishing financial obligation relief and financial security. Debt specialist solutions use specialized assistance for individuals grappling with monetary difficulties. By assessing your income, financial debts, and expenditures, a debt expert can assist you identify the origin triggers of your monetary distress, enabling for a much more exact technique to resolution.

Involving financial debt specialist services supplies a calculated technique to achieving debt alleviation and monetary freedom. Eventually, the know-how of debt consultants significantly improves the possibility of browsing the intricacies of financial debt management effectively, leading to a more safe financial future.

Report this page